This is an unprecedented time in ocean container shipping. Demand for ocean container is so high that the rates are higher than ever before and there is congestion at terminals all over the world.

The worst of all is the Port of Long Beach and LA, with 45 vessels currently at anchor outside the port complex. This unprecedented congestion level has also contributed to a global container shortage that will negatively affect consumers and companies in the United States for the next 3-6 months at a minimum.

Senior Editor Greg Miller from FreightWaves announces, ” It’s official: Container volumes in the Asia-U.S. trans-Pacific trade have hit their limit. Massive port congestion in the ports of Los Angeles and Long Beach is forcing ocean carriers to take extreme measures. Sailings are now being “blanked” (canceled) not because of lack of demand, but because of lack of tonnage as ships are stuck awaiting berths.”

“Fleets are being fully deployed and stretched beyond capacity, this is regretfully currently not an option,” according to Hapag-Llyod as ships are falling behind schedule due to these long traffic jams in port. Schedule reliability has been falling through the roof since last summer July 2020 due to covid lockdowns and thinning work schedules. Many of the work force ,from truck drivers to port handlers ,had to slim down due to Covid restricts or falling ill to Covid. This has been causing pileups at ports from Asia to Los Angeles and Long Beach.

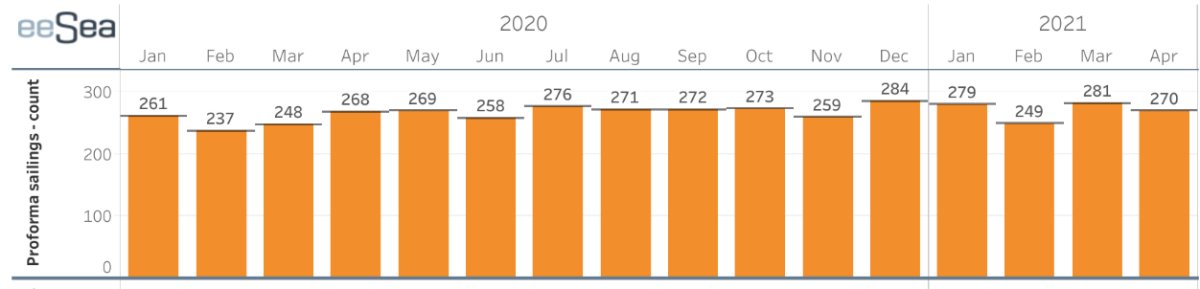

The eeSea Platform provides complimentary access to real-time blank sailing data. As of Wednesday, there has been a 11% drop in AISA-USA sailing in Feb vs Jan despite continued high cargo demand.

(Asia-U.S. scheduled sailings by month (Chart: eeSea))

There is no let up in San Pedro Port. Here you can see all the vessels anchored at bay waiting to port. With the growing Covid case surge among dockworkers, there just isn’t enough man power to service the ships any faster.

(San Pedro Bay container-ship positions Jan. 27 (Map: MarineTraffic))

Read more about this and listen to Greg’s full article with the link below:

Resource( https://www.freightwaves.com/news/trans-pacific-tr…)

No responses yet